Call for World’s Largest Food Companies to Prioritise Health after NEW Survey Exposes Bad Practice

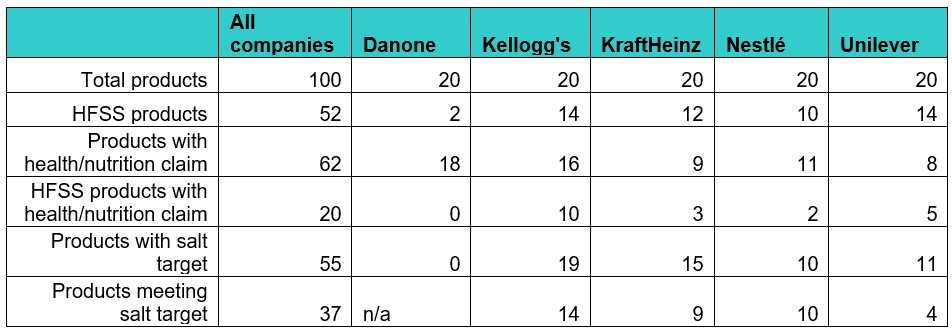

- Over half of UK ‘flagship’ products surveyed from 5 of the largest global food companies are ‘unhealthy’ – i.e. high in fat, salt and/or sugar (HFSS) – although differences between companies exist, according to a NEW snap shot survey

- Over a third of the ‘unhealthy’ products surveyed display misleading nutrition and health-based ‘health halo’ claims as part of their product description

- One in three products surveyed within the Department of Health's salt reduction programme failed to meet their targets, with Unilever lagging furthest behind

- Health charities call for major global food businesses to increase the proportion of healthy vs unhealthy products they sell and stop making health claims on unhealthy products

- An immediate Government intervention is also required to level the playing field, including regulating salt, sugar and fat targets, and shortening the delay on unhealthy food & drink advertising and promotions restrictions, plus the introduction of honest labelling

Two UK health charities are calling on some of the world’s largest multinational companies to urgently improve the healthiness of the products that they sell, including stepping up their efforts to reformulate their popular brands. This comes after a new snapshot survey suggests many of their products are classified as ‘unhealthy’ due to their high levels of salt, sugar and/or saturated fat, and low levels of fibre, protein, fruit and/or vegetables [i],[ii].

Research by Action on Salt, the expert group based at Queen Mary University of London, supported by charity ShareAction, identified[iii] 100 key ‘flagship’ products produced by Danone, Kellogg’s, Kraft Heinz, Nestlé, and Unilever and found over half of all the ‘flagship’ products surveyed would be considered ‘unhealthy’. In most cases this is in stark contrast to the image they try and create as global leaders in improving the healthfulness of their food and drinks.

Worryingly, nearly two-thirds of Kellogg’s and Unilever’s ‘flagship’ products surveyed are deemed less healthy. Danone has the lowest proportion of ‘flagship’ products which score as less healthy (just 2 in 20), showing companies can still be profitable even if they increase the proportion of healthy vs less healthy products they sell.

These results also suggest that certain manufacturers are likely to be more greatly impacted by forthcoming promotions and advertising restrictions on unhealthy products. The first strand of restrictions, to limit unhealthy products being promoted in prominent places such as checkouts, will come into force this October. Rather than fight the restrictions, these companies should step up their efforts to reformulate their products responsibly so that the restrictions would no longer apply. Companies are also able to mitigate profit losses while supporting public health by shifting their marketing and advertising towards healthier options. Indeed, by their own estimates, Kellogg’s could suffer revenue losses in the region of £100m if they do not adapt [viii].

Examples of similar products where marketing restrictions will only apply to the less healthy product that fails the Nutrient Profile Model (NPM) [ix],[x]:

.png)

Almost two-thirds of products included in this survey display nutrition, health and sustainability-based claims as part of their product description[xi]. With the exception of Danone, the findings from this survey suggest this practice is widespread with over a third of all companies’ unhealthy ‘flagship’ products surveyed using a nutrition or health-based claim. Although all companies are using health and nutrition claims legally[xii], evidence suggests this ‘health halo’ effect can distract shoppers from scrutinising the nutrition labels more carefully[xiii].

Kellogg’s has health or nutrition claims on almost three quarters of their less healthy food products included in the snap shot survey. Making health claims on unhealthy products should raise ethical concerns about the behaviour of these companies. We call on global food companies to shift their marketing from such an approach to one that champions genuinely healthier options.

Graham MacGregor, Professor of Cardiovascular Medicine at Queen Mary University of London and Chair of Action on Salt, says: “It’s a national scandal that most of these big food companies are blatantly contributing to the number of people dying and suffering unnecessarily from strokes and heart disease, which remains the biggest cause of death in the UK. Improving the nutritional content of foods by reformulating recipes with less salt, sugar and saturated fat is by far the most important strategy to prevent obesity and heart disease. Fundamentally, we need these companies to be more responsible and for the Government to take full control with strict measures to include mandatory targets for reformulation, well enforced marketing and promotions restrictions (including shortening the delay to ban multi-buys and advertising) and better food-labelling requirements.”

Hattie Burt, Policy & Communications Officer at Action on Salt adds: “These foods can and should be improved to contain less salt, sugar and saturated fat, and more fibre, protein, fruit and vegetables. If retailers and smaller food manufacturers can achieve it[xiv], so can these big multinational organisations. Unfortunately, it seems that with the Government failing to properly enforce salt and sugar targets, or to implement much-needed public health legislation - producing healthy, nutritious food is just not a priority for all of these big food companies.”

Ignacio Vazquez, Head of Health at ShareAction, says: “While some manufacturers are taking steps to increase their sales of healthy foods, the overall picture is of an industry lagging behind. The impact of obesity on a healthier society is clear and investments in companies over-reliant on the sales of unhealthy foods are fast becoming stranded assets. We have seen the UK retail market respond to these issues by setting clear targets to increase their sales of healthy foods over time. Shareholders of food manufacturers need to call on them to do the same."

Annex 1: List of products included in the dataset [PDF 219KB]

Annex 2: Summary tables on HFSS products, salt targets and health/nutrition claims

Comments from food manufacturers:

Danone

“At Danone we’re proud of our healthy portfolio and are pleased to have this recognized through Action on Salt’s survey – which describes Danone as having the ‘lowest proportion’ of unhealthy flagship products. As one of the top food and drink businesses in the UK with market-leading brands such as Actimel, Alpro, and Volvic, the health of the nation is a top priority for us. We will continue innovating, reformulating, and working with retailers and industry groups to support the health of consumers. We urge the rest of the industry to join us in putting health first - going beyond just meeting regulatory standards, and actively working to make healthier choices the easy option."

Kellogg’s

“This survey is not based on our top selling products, nor is it representative of our full product range.

Four out of five of Kellogg’s top-selling cereals are non-HFSS and by next year all of our children’s cereals will be non-HFSS. We will continue to renovate our food and launch new cereals and snacks to meet our consumer’s needs, for example the expansion of our range of non-HFSS high-fibre wheats range in the UK.

We are always really open about what's in our food by including things like traffic light labelling so people can make their own mind up about whether they want to buy our products or not. All the claims we use on pack follow the rules set down in law.”

References

[i] Products high in saturated fat, salt and/or sugars (HFSS) are defined by the Department of Health Nutrient Profiling Model (NPM) - foods scoring 4 or more points and drinks scoring 1 or more are classified as HFSS (less healthy). Department of Health and Social Care, 2011. Nutrient Profiling Technical Guidance. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/216094/dh_123492.pdf

[ii] NPM scores are calculated using estimates of fruit, vegetable and nut content and gravities of liquids based on the best available data.

[iii] Survey Details: – Action on Salt and ShareAction identified up to 20 products from each global food business, focusing on ‘flagship’ products aka those which are widely available to purchase across the UK. Identification of products were obtained from online sources, including company websites and publicly available market and consumer data. Baby and infant foods were excluded from product selection as they do not meet the criteria for determining foods high in saturated fat, salt and/or sugar (HFSS).

NOTE: This survey is not a fully comprehensive food and drink survey, and products span a range of different food categories, so direct comparisons with brands cannot be made. But this survey does give us an indication of the types of food and drink these companies make, and their overall healthfulness.

Full nutritional information (energy, fat, saturated fat, sugars, fibre, protein, and salt per 100g and per portion) was collected online from major retailer websites in June 2022. In addition to nutrition information, the use and type of nutrition and health claims, as well as the full ingredients list, was recorded.

[iv] Government criteria for colour coding on a front of pack label https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/566251/FoP_Nutrition_labelling_UK_guidance.pdf

[v] PHE (2020). Salt reduction targets for 2024. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/915406/2024_salt_reduction_targets_070920-FINAL-1.pdf

[vi] PHE (2020). Salt reduction targets for 2024.

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/915406/2024_salt_reduction_targets_070920-FINAL-1.pdf

[vii] PHE (2017). Sugar Reduction: Achieving the 20% https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/604336/Sugar_reduction_achieving_the_20_.pdf

[viii] https://www.thegrocer.co.uk/health/kelloggs-hfss-laws-would-cost-113m-in-lost-sales/668568.article

[ix] Foods can be made healthier, by increasing positive nutrients (like fibre, protein, fruit and vegetables) and reducing unhealthy nutrients (sat, sugar, saturated fat). This is measured by the Department of Health’s Nutrient Profiling Model (NPM) Score to define a product as ‘healthier’ (pass) or ‘less healthy’ (fail).

[x] Department of Health (2011). Nutrient Profiling Technical Guidance https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/216094/dh_123492.pdf

[xi] Nutrition/health claims were identified as those included as part of a product’s description.

[xii] Under EU legislation (EC) No. 1924/2006 (fully adopted by the UK), regulation is in place for businesses wanting to make nutrition and/or health claims on their products.

[xiii] Hawley et al., (2012). The science on front-of-package food labels.

[xiv] In May 2022, challenger brands wrote an open letter to the Prime Minister contesting the delay to advertising and promotions restrictions https://www.thegrocer.co.uk/health/hfss-restrictions-delay-challenger-brands-write-to-pm-in-protest/667615.article